Hanoi, Vietnam – In the heart of Vietnam’s bustling industrial zone, a Vietnamese-owned color box packaging factory reveals a striking parallel to China’s manufacturing success story. During a recent visit to TIEN VINH (Jinrong) Packaging, a decade-old facility now operating a newly invested secondary plant, we witnessed a packaging ecosystem uniquely mirroring China’s proven model—prioritizing efficiency, cost control, and integrated automation. This case underscores Vietnam’s rapid adoption of Chinese industrial strategies and highlights why Chinese packaging equipment dominates emerging markets.

The TIEN VINH Model: Efficiency at Scale

Nestled beside a tranquil creek in Hanoi, TIEN VINH’s two factory buildings showcase operational precision:

- Pre-press operations on one bank, post-press on the other.

- Two corrugated paper lines, two offset printing presses, laminating machines, and flute laminators run seamlessly.

- Primary clients: Top Vietnamese food, beverage, and FMCG brands (including BIA VIETGOLD, Vietnam’s #1 beer).

Unlike Western models, TIEN VINH thrives on high-volume, cost-sensitive production—demanding lean operations and low overhead. This mirrors China’s packaging industry, where efficiency drives profitability. Crucially, 50% of TIEN VINH’s corrugated board is exported, proving its global competitiveness.

Chinese Equipment as an Industry Backbone

A tour of the workshop revealed a telling detail: nearly every machine bore a Chinese brand. The reasons are practical:

- Completeness of the supply chain: China supplies the full cascade of machines and consumables needed for color box manufacturing.

- Competitive capital and operating costs: Chinese machines typically balance automation with cost-efficiency—critical for margin-sensitive clients.

- Local aftermarket and parts availability: Suppliers from Guangdong and other manufacturing hubs have built support networks across Southeast Asia, enabling faster service and spare-part delivery.

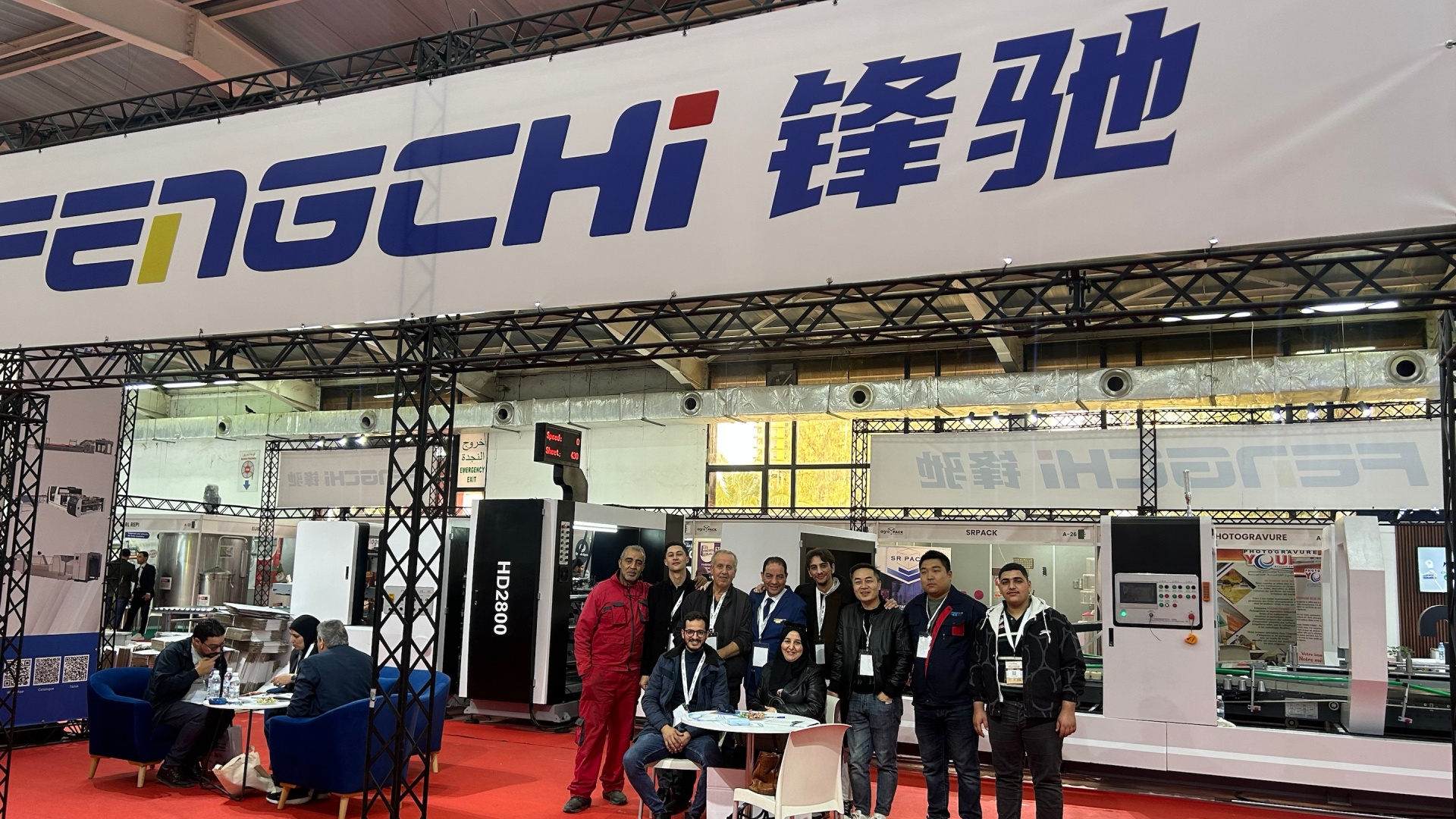

Fengchi: A Leading Force in Vietnam’s Packaging Revolution

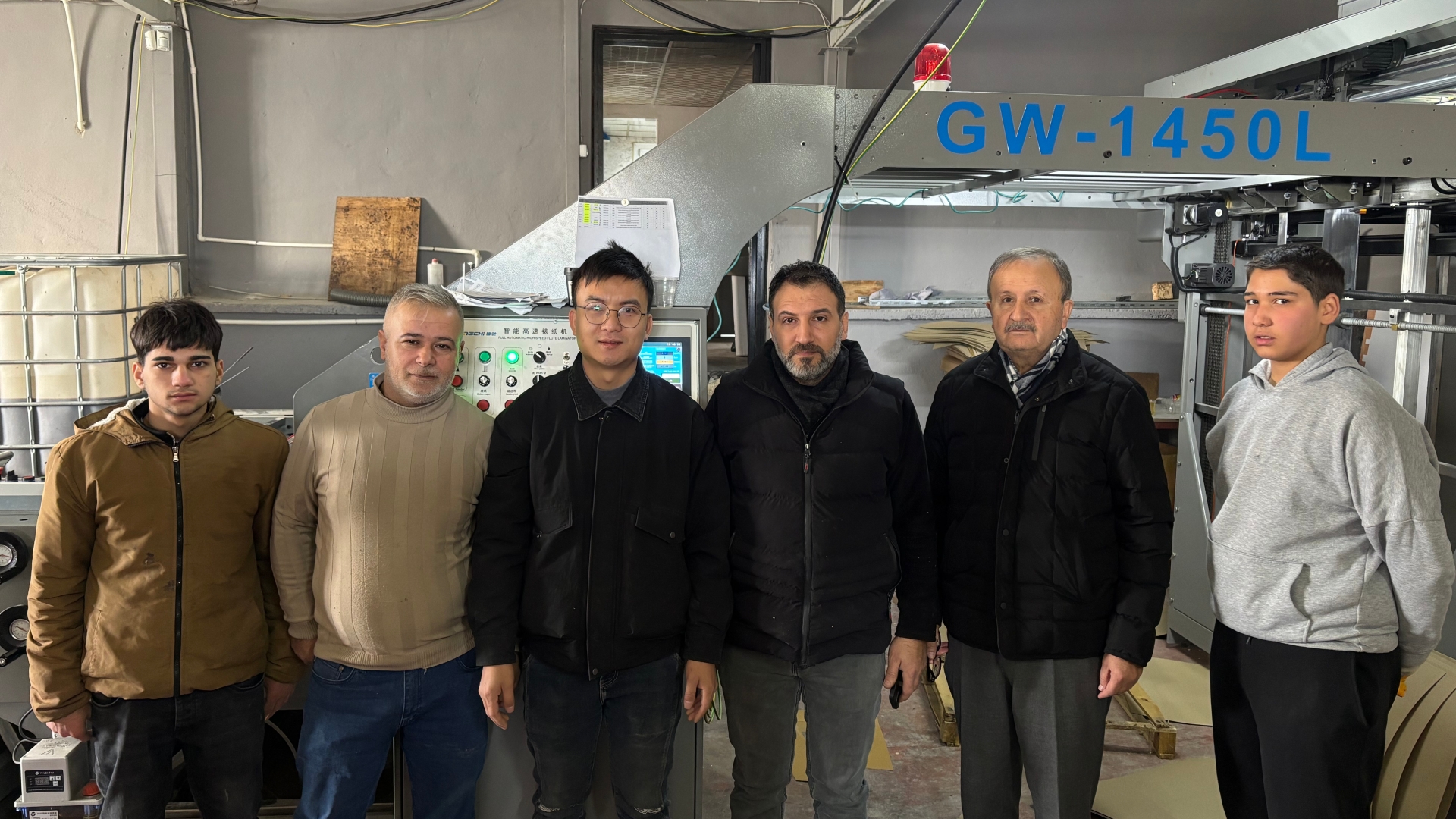

This case study highlights why Guangdong Fengchi has become the preferred Chinese equipment brand for Vietnam’s color box industry. With over 80 sets of Fengchi flute laminators and production lines operational across Vietnam, the company has secured a leading market share. Fengchi’s success is rooted in a partnership model that goes beyond mere equipment sales.

As the first client of Fengchi among local Vietnamese color box manufacturers, TIEN VINH/Jinrong Packaging exemplifies this relationship. Fengchi doesn’t just design, manufacture, and install flute laminating machines; it provides holistic problem-solving and guides partners toward optimal, workable solutions. This approach is perfectly suited to a market that demands reliability, cost-effectiveness, and rapid scalability.

Conclusion: A Replicated Model with Local Roots

The visit confirmed that Vietnam’s packaging ecosystem is a stable, growing market with strong, sustained demand for automated machinery. The business model—prioritizing high volume, low cost, and operational efficiency—is a direct echo of China’s path, adapted by savvy local operators. For manufacturers looking to enter or expand in Vietnam, the lesson is clear: success is built on the foundation of proven technology and deep operational support, a combination that Chinese equipment providers like Fengchi are expertly delivering. This synergy between Vietnamese entrepreneurial spirit and Chinese industrial innovation is powering the next chapter of Southeast Asia’s manufacturing story.

FAQ

Q: Who is TIEN VINH (Jinrong) Packaging?

A: A Vietnamese-owned color box factory in Hanoi operating for over a decade; it supplies local FMCG and food/beverage brands and offers contract manufacturing for major beer brands.

Q: Why do Vietnamese factories buy Chinese flute laminators?

A: Chinese manufacturers offer a complete supply chain, competitive pricing, proven performance, and strong local service networks—key for high-volume, cost-sensitive operations.

Q: What production model do Vietnamese packaging firms follow?

A: Many replicate China’s vertically integrated model—pre-press, offset printing, lamination, corrugated production and finishing—often on a single campus to lower costs and speed delivery.

A field report from Hanoi: how a decade-old Vietnamese color box factory (TIEN VINH / Jinrong Packaging) has replicated China’s production model, why Chinese flute laminators and automated lines dominate, and what this means for efficiency, outsourcing and export opportunity.